Q1 2024 Insight Report

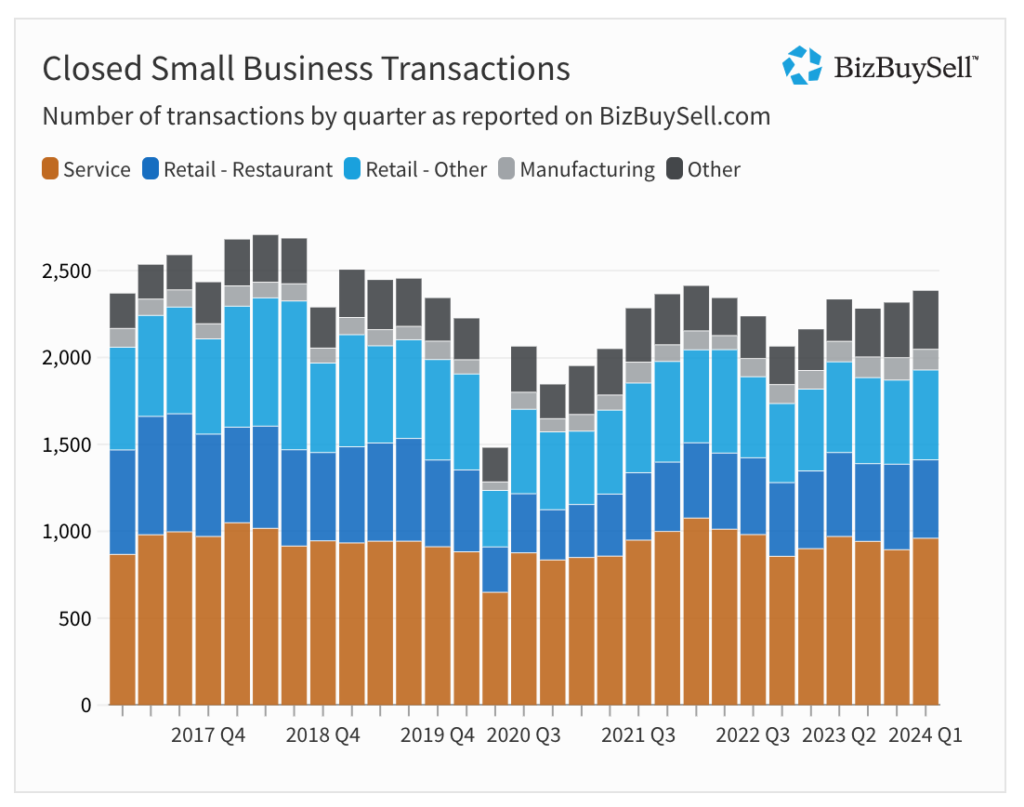

Small business acquisitions grew 10% over the previous year and 3% over the previous quarter, according to BizBuySell’s Insight Data, which tracks and analyzes U.S. business-for-sale transactions and sentiment from business owners, buyers, and brokers. A total of 2,384 businesses changed hands in the first quarter, representing an enterprise value of $1.8 billion, which is 24% higher than the same time last year.

Small business acquisitions grew 10% over the previous year and 3% over the previous quarter, according to BizBuySell’s Insight Data, which tracks and analyzes U.S. business-for-sale transactions and sentiment from business owners, buyers, and brokers. A total of 2,384 businesses changed hands in the first quarter, representing an enterprise value of $1.8 billion, which is 24% higher than the same time last year.

After a relatively flat 2023, bogged down by rate hikes and the economy teetering between recession and a soft landing, deals appear to be moving forward again. In fact, U.S. banks anticipate an increase in demand for loans in 2024, according to a recent Federal Reserve survey. That said, with inflation still above the Federal Reserve’s 2% target, comments by Fed Chair Jerome Powell indicate rate cuts are not likely to happen anytime soon.

For now, borrowers appear to be adapting to the higher for longer rate environment. Max Friar, managing director of Calder Capital, comments, “The memory of low rates is fading, and the reality of higher rates (well into the future) is helping everyone get present to reality. The (finally) largely sensible changes that the SBA has made regarding partial ownership and loosening the rules around seller financing are solid attempts to widen the buyer pool.”

However, transactions are still 5% below 2019 pre-pandemic levels. Dealmaking is becoming more prudent as buyers and sellers carefully consider price and terms to better align with the market. Today 27% of sellers are open to including some portion of seller financing, compared to 22% a year ago. This is good news for buyers, where 85% say they consider it important.

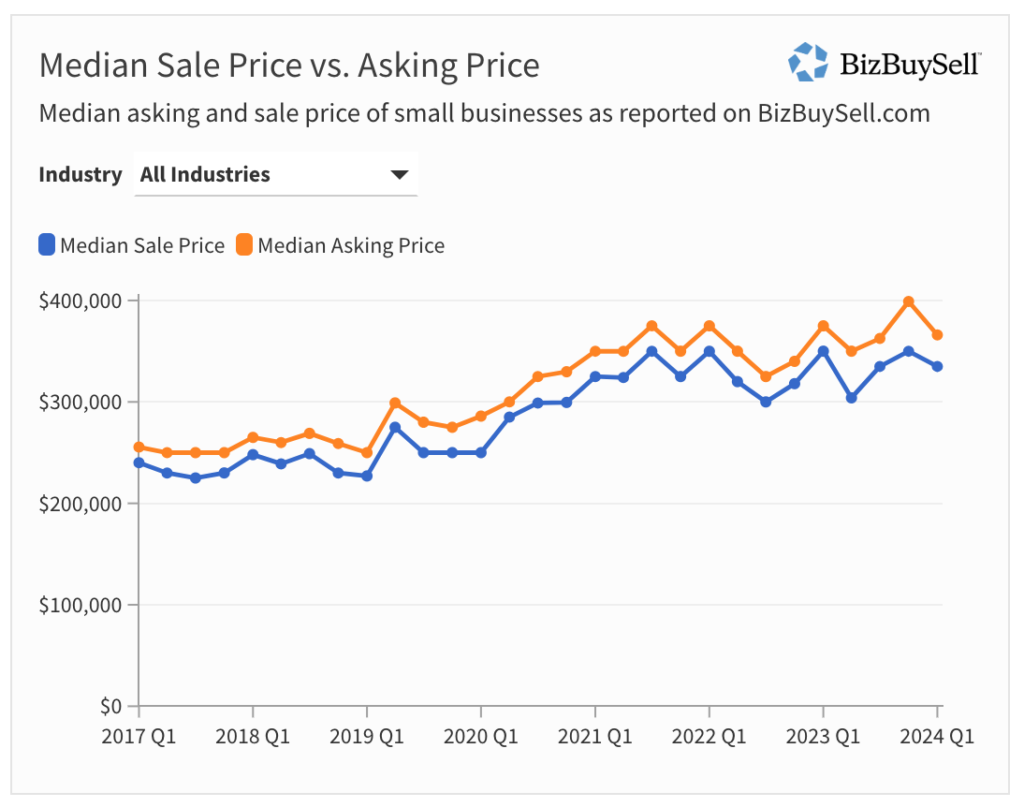

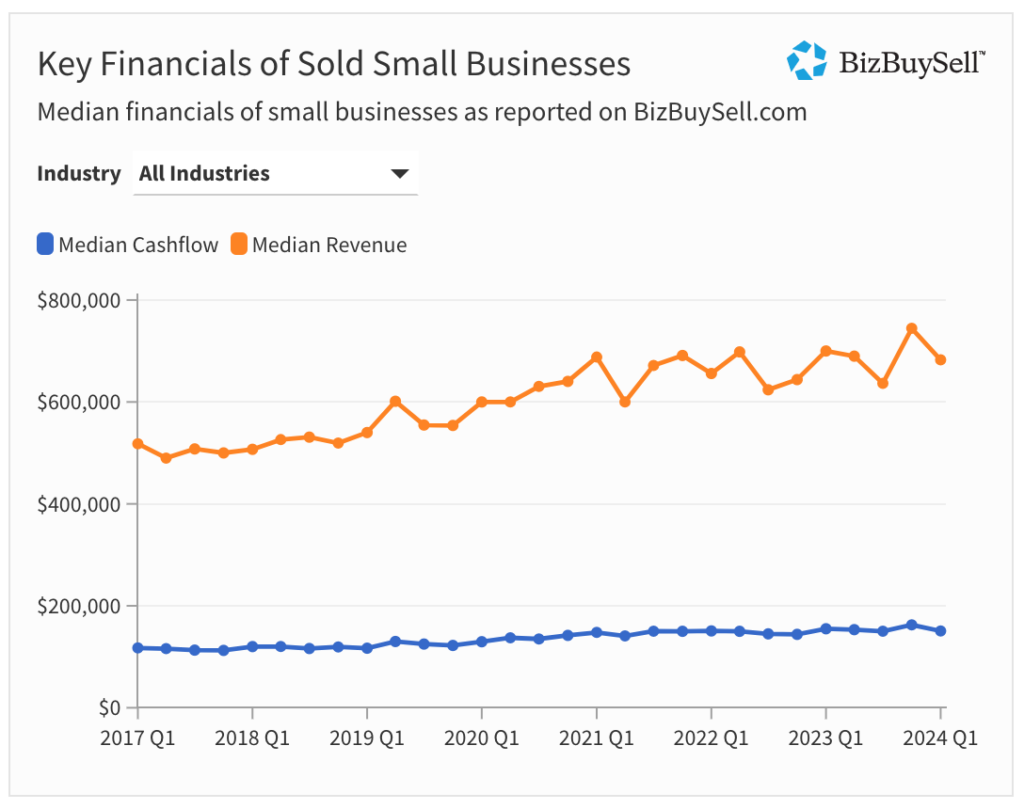

Businesses in Q1 sold at slightly lower prices, with the median sale price down 4% over the previous year. The lower prices correlate to sold businesses reporting weaker financials in the first quarter. Both median revenue and median cash flow of sold businesses dropped 3% over the previous year. Amid inflation and rising labor costs, small businesses are facing thinner margins.

Restaurant Sale Prices Up 9% as Buyers Pay Premium for High Performers

The restaurant sector continues its post-pandemic recovery, as transaction volume remains steady year-over-year, yet 8% lighter than the previous quarter. Buyers focused on higher-priced restaurants, with the median sale price up 9% since last year and 13% since last quarter.

The restaurant sector continues its post-pandemic recovery, as transaction volume remains steady year-over-year, yet 8% lighter than the previous quarter. Buyers focused on higher-priced restaurants, with the median sale price up 9% since last year and 13% since last quarter.

Robin Gagnon, co-founder of We Sell Restaurants, comments, “We are seeing deal sizes much higher than last year and more cash buyers which supports that some buyers have simply been holding onto cash and sitting on the sidelines but have now jumped in. We are also seeing existing owners of franchise units much more willing to look at resales versus building from the ground up.”

Restaurants that sold in Q1 also show healthy financials as more customers opt to dine out, with median revenue up 11% over the previous quarter and 9% over the previous year. Median cash flow was up 14% over the previous quarter and 4% over the previous year.

As Q1 sale prices indicated, buyers are willing to pay more for restaurants with strong financials – those winning some of the toughest challenges around wage hikes and higher food prices. Whether it’s high-volume popular mainstays or high-tech convenience, many restaurants are on the upswing.

70% of Small Businesses Say Inflation Not Easing, Labor Costs Weigh Heavy

Not surprisingly, most small businesses feel the bite of inflation, with 70% of owners surveyed saying inflation is not easing. In fact, the Consumer Price Index accelerated to 3.5% in March, marking the third consecutive strong reading. With rising operating costs, from fuel and utilities to food and employee wages, many small businesses have been forced to raise prices. Others fear losing customers.

M. Lothridge of Mountain Laurel Farm describes trying to manage rising costs, “As a small business owner, I can attest to how absurd the inflation has become. It’s like trying to navigate a minefield while blindfolded. Every expense feels like a punch to the gut, making it incredibly challenging to stay afloat.”

Furthermore, as the labor market continues to shrug off high interest rates, 29% of small business owners struggle with payroll costs, with some claiming it eats up 50-60% of their revenue. LaTrena of LFR Convenience Store states, “I cannot afford payroll because of the prices. I always have to work for free so my customers can get the same items for a better price.”

Raising minimum wage has been a heated debate. Although 81% of small business owners say they are already paying above minimum wage, 44% say rising minimum wages have had a negative impact on their business. Nearly half (47%) of those understaffed are having trouble attracting qualified applicants.

Small Businesses Say Adding Tips to Checkout Eases Pressure on Raising Wages

During the height of the pandemic, tipping became a way for customers to show their appreciation for a wide range of services. Since then, new technologies have enabled businesses to continue this practice by including a suggested tip amount. According to a study by Pew Research, seven-in-ten Americans say tipping is expected in more places than it was five years ago.

During the height of the pandemic, tipping became a way for customers to show their appreciation for a wide range of services. Since then, new technologies have enabled businesses to continue this practice by including a suggested tip amount. According to a study by Pew Research, seven-in-ten Americans say tipping is expected in more places than it was five years ago.

While adding a suggested tip amount to the checkout is expected for restaurants, bars, and beauty salons, 18% of owners surveyed said they’ve added tipping prompts to their payment system since the pandemic. Of those who added it, 42% say it has eased the pressure of raising employee wages.

Robert Vodicka of Sun Life Cleaning Services LLC comments, “We have tipping and compensation plans in place, but the tips definitely help.”

Lee Sheridan of Two Maids of Southeast Virginia adds, “We see over $12k in tips a month.”

71% of Small Businesses Utilizing AI Say It Has Improved Business Performance

Leveraging new technologies plays a large role in small businesses remaining competitive – from the latest payment processing systems to implementing artificial intelligence (AI). Thirty-five percent (35%) of small business owners say they now use AI in their business. Of these new users, an overwhelming 71% say AI has improved their business’s performance. Marketing is where most owners (69%) are leveraging AI, followed by analytics (37%), and customer service (28%) rounding out the top three use cases.

M. Lothridge adds, “AI has led to increased efficiency, better decision-making, and enhanced customer experience. By automating repetitive tasks, analyzing vast amounts of data, and providing valuable insights, AI has helped me streamline operations, reduce costs, and stay ahead of the competition. Overall, AI has been instrumental in driving growth and success for my business.”

Retail Business Acquisitions Pick Up, Sale Prices Drop 16% as Profits Weaken

After two consecutive quarterly declines in closed transactions, the number of retail businesses sold in Q1 grew 7% over the previous quarter and 10% over the previous year. However, this increase in volume was made up of lower priced deals, with the median sale price declining 17% from the last quarter and 16% from last year. This uptick in acquisitions suggests more sellers are motivated to close deals.

Retail businesses that sold in Q1 also reported weaker financials, with median revenue down 6% over the previous year and median cash flow down 10%, respectively, indicating buyer demand could be focusing less on current performance and more on future opportunity.

With more Americans shopping online, and inflation driving consumers to cut back on non-essentials, many brick-and-mortar retailers are adapting to new trends to remain competitive. A heavier focus on in-store customer experience and integrating shopping with e-commerce are just a few examples.

Service Businesses Show Thinner Margins as Sale Prices Decline

The service sector showed a trend similar to retail in Q1, with moderate growth in acquisitions but weaker sale prices and weaker financials. Closed transactions grew 7% over the previous quarter and 7% year-over-year, while the median sale price declined 5% from the previous quarter and 7% from the previous year.

While inflation and the rising costs impact every business sector, service businesses typically are considered lower risk with wider margins. Q1 sold businesses reported revenue declined 4% from the previous quarter and 5% from the previous year, while cash flow edged up 3% over the previous quarter and 3% over the previous year.

Demand for Distressed Manufacturing Businesses Rises as Sale Prices Drop 20%

The manufacturing sector showed strong growth in the number of acquisitions, with closed transactions up 11% over the previous year, yet 8% down from the previous quarter. Median sale prices declined 20% from the previous year and 21% from the previous quarter, which is the sharpest drop since Q2 2022 when the Fed first began a series of rate hikes to tamp down inflation.

Manufacturing businesses sold in Q1 also showed weaker financials. Median revenue declined 11% from the previous quarter and 8% from the previous year. Median cash flow declined 25% from the previous quarter and 17% from the previous year. This may indicate buyers are more focused on investing in these facilities as assets and implementing new business objectives.

Friar adds, “We are seeing pockets of distress. It is hard to believe, but PPP (Paycheck Protection Program), ERC (Employee Retention Credit), and EIDL (Economic Injury Disaster Loan) programs have continued to prop up many companies. We are seeing more of those that are likely to not make it on their own. As a result, we have beefed up our distressed practice.”

Market Outlook

Heading into the year, the business-for-sale market has shown its ability to tolerate higher interest rates and continue its path toward a post-pandemic recovery. Despite the challenges of inflation and minimum wage hikes cutting into profits, the economy remains strong, unemployment is relatively low at 3.8% and a recession seems less likely.

Still, maintaining healthy financials amid rising inflation can be challenging. Add high interest rates to the mix and the question is whether to remain on the sidelines until conditions improve or to move forward. Owners appear optimistic that the future will present a profitable exit ramp if desired. When asked to name their most difficult and profitable year, the majority (31%) of owners said 2020 was their most difficult, while 41% said they expect 2024 to be the most profitable.

Furthermore, 14% of owners say they are actively selling their business while 17% plan on selling between now and next year. Of buyers surveyed, 87% say they plan on buying a business within the next two years and most (53%) say they are not delaying their timeline until interest rates drop. This compared to 24% of buyers who are delaying and the final 23% unsure.

The upcoming presidential election adds yet another layer of uncertainty. Most owners (71%) surveyed believe that if Trump is elected president, this would have the best impact on small businesses, with many commenting he has a better understanding of businesses and how they are affected by policy decisions.

2024 Deals Expected to Pick Up Pace, More Sellers Plan to Offer Seller Financing

As buyers and sellers adjust to current conditions, transaction activity is expected to pick up pace. With interest rates not likely to come down until the latter half of the year, if at all, buyers and sellers have less incentive to wait on the sidelines. Moreover, economic output is expected to expand this year, mainly due to the resilience of the U.S. economy, according to a recent International Monetary Fund forecast.

Friar offers his perspective, “My prediction is that seller activity will pick up in Q2 and Q3, leading to a very robust Q4 2024 and Q1 2025 in terms of closings. I also feel that, barring any major economic disasters, 2025 will be a very strong year for sellers engaging to sell. This is because: a) seller sentiment will continue to tick up; b) rates may finally start to tick down; and c) there will be clarity on the 2024 election results and therefore policy decisions affecting the economy for the next four years.”

Changes in deal structure are one such way transactions have moved forward. More sellers are coming to realize that some level of seller financing, typically 10-20%, should be expected to secure the deal.

Buying Businesses with Commercial Real Estate Can Offer Longer Repayment Terms

Businesses that include commercial real estate loans allow buyers to spread the term to 20 years. Gagnon discusses recent restaurant acquisitions, “We saw increases in selling prices of 78% and some of this was attributable to larger deals that included real estate. We’re seeing more cash deals and on financed deals, more with real estate, which is spreading the term to 20 years.”

The SBA’s 504 loan program provides long-term, fixed-rate financing, which can be used for purchasing or construction on existing commercial buildings or land, as well as new facilities. Depending on the lender, repayment terms can be 10, 20, or 25 years.

Sellers More Likely to Attract Buyers with Well-Managed Businesses and Strong Financials

In today’s market, sellers can increase their chances of a successful sale by developing a strategy of looking at it from a buyer’s perspective. Lisa Riley, CEO and M&A Advisor at Delta Business Advisors, says sellers should adopt three key practices :

“First, maintain transparent financials—eliminate any discretionary spending to clearly demonstrate the business’s profitability. Second, take vacations—start with a weekend or two, then extend to a few weeks, or even a month, to show that the business can thrive without your constant presence. Third, invest in the right management team to increase the attractiveness and resilience of your business,” says Riley.