Q2 2023 Insight Report

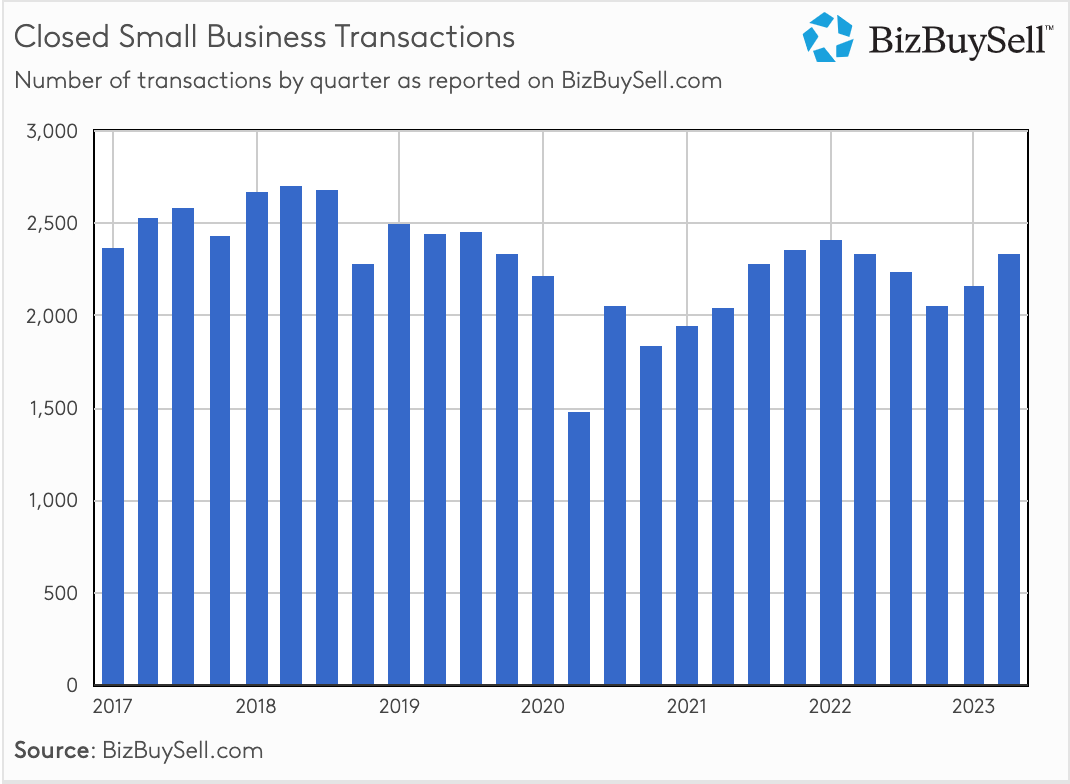

Second quarter business acquisitions climbed 8% QOQ, following a 4.8% gain in Q1, continuing a winning streak as market participants adjust to the new higher interest rate environment. This is according to BizBuySell’s Insight Report, which tracks and analyzes U.S. business-for-sale transactions and sentiment from surveys of business owners, buyers, and brokers.

Second quarter business acquisitions climbed 8% QOQ, following a 4.8% gain in Q1, continuing a winning streak as market participants adjust to the new higher interest rate environment. This is according to BizBuySell’s Insight Report, which tracks and analyzes U.S. business-for-sale transactions and sentiment from surveys of business owners, buyers, and brokers.

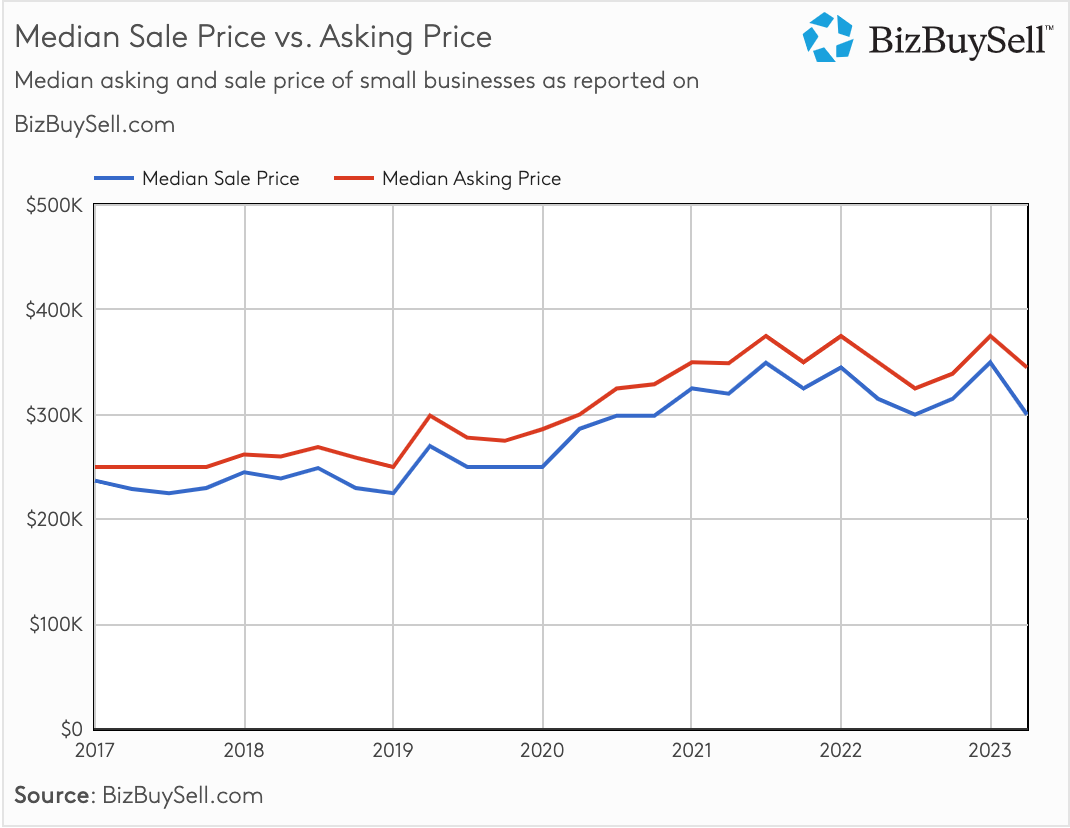

While transactions show steady growth over the past two quarters, prices are trending downward. The median sale price in Q2 dropped 14% to $300,000 from the previous quarter, with the median asking price in Q2 down 8% over the same period.

The drop in sale prices can be attributed to higher interest rates, putting pressure on business values as financing deals has become more costly. The average revenue multiple declined 3.3% from the previous quarter, while the average cashflow multiple declined 1.3%.

While declining sale prices may seem like bad news for sellers, they’re likely more indicative of owners or their business brokers flexing creativity in deal structure to accommodate impacted purchase power.

“Deals are getting more creative. If there is real estate involved or seller owned leased property, we can reduce the business price but make up for it on the real estate creating a win-win scenario for the buyer and seller,” says Katrina Loftin, Co-Founder of California and Nevada based M&A Business Advisors.

Loftin adds, “For example, if there is a $120K gap in what the buyer is willing to pay, you can raise the rent $1,000/month over market rent for a period of 10 years which will result in a minimum of $120K increase and usually more with rent increases. The important thing to remember when using this method, it will lower the valuation on the business slightly. Also, at the end of the lease, rent should return to market rent if there are any further lease extensions.”

Loftin adds, “For example, if there is a $120K gap in what the buyer is willing to pay, you can raise the rent $1,000/month over market rent for a period of 10 years which will result in a minimum of $120K increase and usually more with rent increases. The important thing to remember when using this method, it will lower the valuation on the business slightly. Also, at the end of the lease, rent should return to market rent if there are any further lease extensions.”

Twenty percent (20%) of surveyed business owners own the commercial real estate they use to operate their business, leaving 80% of deals where rent finesse might not be an option, however other creative options to close still exist.

“Higher rates are causing the buyer cash flow post transaction to be tighter than we have seen in recent years. Buyers need to come in with more down, ask for a deferred note, or additional seller financing. Or just offer a lower price to bridge the gap,” says Loftin.

For some owners, especially those on a tight timeline or unwilling to finance the deal, taking less might be the only option. Loftin notes, however, that businesses that proved themselves to be recession-proof continue to demand full price offers.

Seller Financing Critical for Buyers and Lenders; Good News for Sellers

Rather than wait on the sidelines for economic conditions to improve, 56% of owners surveyed by BizBuySell have an exit plan, half of whom are actively selling or expecting to by 2024. Those who enter the market with an attractive business should find interest as buyers continue to seek out good opportunities despite higher interest rates. Forty-eight percent (48%) of surveyed buyers said rate hikes had no impact on their timeline and at the same time, BizBuySell monthly traffic increased 23% in Q2 over the previous year.

Forty-three percent (43%) of surveyed buyers intend to use an SBA or traditional bank loan to finance their acquisition compared to 70% who intend on asking the seller to finance part of the deal. Just 22% of owners plan to offer it, with an additional 28% undecided. Not only can the decision not to offer seller financing greatly reduce the pool of potential buyers, in today’s environment it can also be a deal-breaker for lenders.

“We are seeing at least some amount of owner financing on almost every transaction,” says Loftin. “Many lenders are requiring at least a 10% note from the seller. Buyers are also looking to ease their minds about an uncertain future and asking for some seller financing.”

Shep Campbell of M&A Specialists in Arkansas also stresses the importance for owners to be flexible when it comes to seller financing. “We have found this to be critically important for a seller to be willing to do. In many cases, the buyers want this as much as the lenders. Coming out of COVID, and now with the interest rates rising, lenders are trying to minimize risk and exposure as much as possible and have turned to requiring at least a small portion of seller financing in many cases,” says Campbell.

While not without risks, the benefits of seller financing are greater in a high-rate environment, beyond simply serving as a bridge to close deals. “We leverage seller financing to get more of the asking price for our client – and oftentimes, more than the asking price when you figure in the interest payments,” says Campbell.

Loftin elaborates, “The good news for sellers is with higher interest rates, the rates on seller financing is also much higher than we have seen in the past. This is a great way to appease the buyer’s concerns and defer some of the seller’s immediate tax, all while making a decent return in the process.”

Restaurants Transactions Grow and Prices Rise as Retail Sector Shows Decline

Restaurants have been making a steady comeback since locations reopened after the pandemic and owners expanded from takeout to indoor dining. Transactions rose 10.3% in Q2 over the previous year following a 3.2% gain in Q1 2023. Yet even as dining out is becoming popular again and demand for restaurants remains strong, transaction activity remains below 2019’s pre-pandemic levels.

Restaurants have been making a steady comeback since locations reopened after the pandemic and owners expanded from takeout to indoor dining. Transactions rose 10.3% in Q2 over the previous year following a 3.2% gain in Q1 2023. Yet even as dining out is becoming popular again and demand for restaurants remains strong, transaction activity remains below 2019’s pre-pandemic levels.

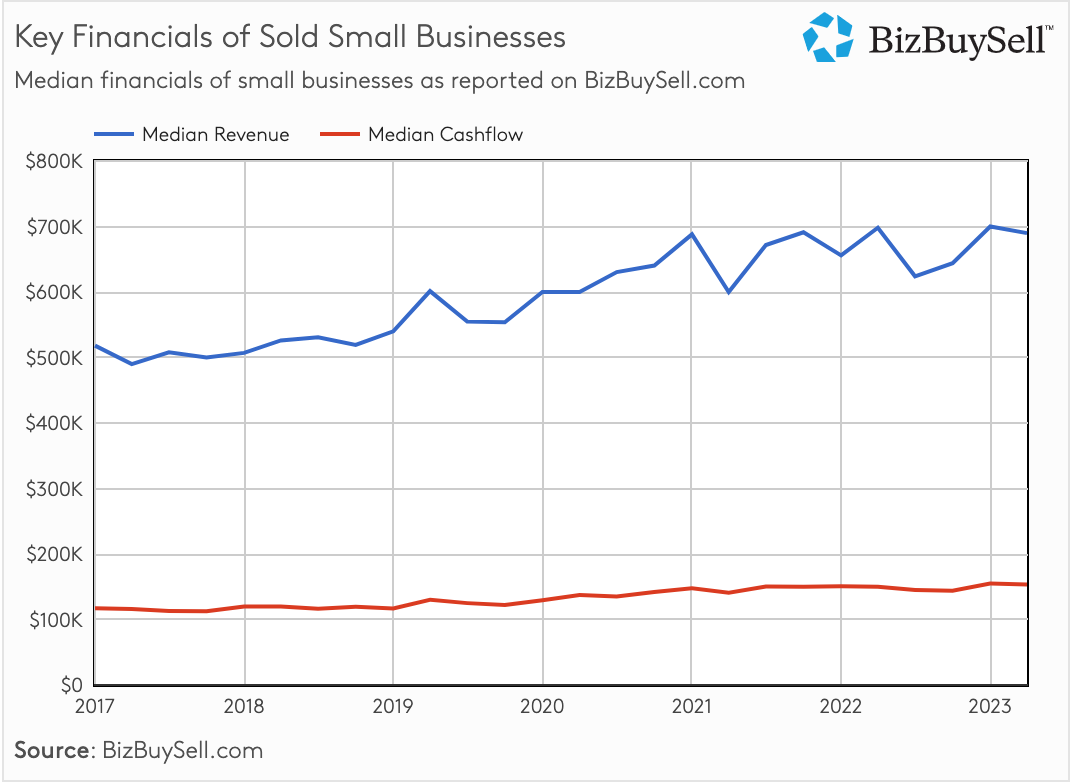

Restaurants that sold in Q2 generated more revenue and buyers paid more for them. The median sale price rose by 15.9% over the previous quarter and 6.7% over the previous year, with median revenue up 10% over the previous quarter and 11.3% year-over-year. Despite higher food and labor costs, median cash flow was up 4.2% over the previous quarter, yet down 1.4% over the previous year.

Real estate firm JLL’s 2023 report on the industry confirms the return of restaurants, with a 6.2% increase in dine-in traffic from February last year, as reported by Costar News.

Steve Zimmerman of Restaurant Realty Company in California notes, “Buyer demand seems strong and especially for buildings with food and beverage operations that are owned by the operator.”

While restaurants appear to be rebounding in today’s market, Zimmerman cautions “there are a number of restaurants whose sales volume and profits are still down from the pre-COVID period. Many operators are holding on by a string and are burning through their PPP money as their lifeline. Others may have sales volumes equal to or ahead of the pre-COVID period, but with profits down as operators are not able to increase prices enough to offset increased operating costs.”

These struggling operations could represent takeover targets by competitors in seek of equipment, employees, or location upgrades. They also represent an opportunity to get up and running quickly for new operators without the hassle or cost of securing brand new assets.

In contrast to restaurants, the retail sector shows declining numbers. After making a strong post-pandemic comeback in 2022 with annual growth in transactions of 22%, sale prices up 12.4%, and revenue surging 18%, the retail sector contracted in the second quarter. Compared to the prior year, second quarter retail transactions declined 12.3%, sale prices dropped 22%, revenue slipped 24%, and cash flow declined 9.4%.

Since the pandemic, retail spending as well as other business has shifted online, narrowing the brick and mortar playing field to fewer stronger competitors. Furthermore, the ‘new normal’ of inflation and high interest rates has left some retailers experiencing declining sales as spending shifts more in favor of cheaper alternatives and fewer non-essential purchases.

Buyers Seek Stability and Independence

The number of individuals embracing entrepreneurship over traditional employment is on the rise. Forty-six percent (46%) of surveyed buyers said they want to leave their current job to be more in control of their future, with an additional 13% newly unemployed and saying the same.

“I have zero control over my salary. I haven’t had a raise in three years and it’s likely it won’t change much even if I go to another company. I want to take control over my financial health and earn a better income for the skill sets I have, not because someone else is trying to determine my value. Baby boomers are exiting the landscape and have done an incredible job building profitable, secure, recession-proof businesses,” said Amanda Gates, who is interested in acquiring a service or online business in Tennessee.

Interestingly, not everyone in the baby boomer generation is heading for the exit. Some are using retirement as a time to invest in a new venture. Twelve percent (12%) of surveyed buyers identified as recently retired.

“While I am a baby boomer, I still believe I have a good decade left to own and run my first business. And I believe there are a good number of business founders/owners who are ready to move on into retirement and willing to sell what they have built over multiple decades at a fair and reasonable price,” said Mark Thompson, who is looking for a service business in Washington.

As highlighted by both Gates and Washington, service businesses are popular acquisitions for those seeking stability. Nearly half of 2nd quarter sales took place in the service sector and 59% of surveyed buyers indicated a desire to own a service business. Additionally, these businesses continue to exhibit healthy financials with median cashflow up 4.5% over last quarter.

“Any business that has shown to be recession-resistant in the past is very popular. We are most often asked for businesses with a recurring income component. Service businesses that are essential are more popular than prior years. Business to business, third party logistics, and manufacturing are always popular and remain so,” said Loftin.

Scot Cockcroft of Sigma Mergers & Acquisitions LLC in Texas specifies businesses that provide services to home owners, such as HVAC and landscaping, as being in high demand.

Rate Hikes Headline Market Outlook

As with residential real estate, small business market behavior is strongly tied to interest rates. The question becomes, how long will they continue to rise? In June, The Federal Reserve paused rate hikes after 10 consecutive increases, however, multiple indicators hint the pause may not be long lived. In fact, many economists expect another 25-basis point increase as soon as the July 26th Fed meeting.

According to ADP, the private sector added 497,000 jobs in the month of June, more than double the Dow Jones consensus estimate of 220,000. In addition, U.S. Department of Labor tracked U.S. jobless claims dipped to 237,000 for the week ending July 8th from 249,000 in the prior week, and below economist forecasts of 250,000 claims. The lack of progress in the Fed’s goal of cooling the job market is an influential factor in additional hikes.

It’s worth noting, however, that the strong labor numbers could simply be a sign of a return to normalcy for a small business sector that has faced severe hiring challenges. Of jobs added, 299,000 were from businesses with fewer than 50 employees. Furthermore, 232,000 jobs were added in leisure and hospitality, which includes food and beverage businesses, a sector notoriously ‘beat-down’ by the pandemic and now on a possible recovery according to BizBuySell data.

Alexis Bauer of Octopus Coffee in Colorado is one such owner who is seeing signs of an improving job market. “The labor market is definitely better, thank God! Retention is increasing too. 2021 was so ugly, and 2022 not much better, but now I’ve got crew coming on this year with the company and no signs of leaving,” said Bauer.

BizBuySell survey data implies job numbers might continue to rise above estimates as most owners are still struggling to find talent. Just one out of five of surveyed business owners said the labor market is improving despite the strong job numbers in the small business sector. Interestingly, 29% of restaurant owners indicated improvement, the most of any sector, versus 24% of service owners, which is the least. This data complements leisure and hospitality trends reported by ADP and points to the unique challenges for specialized sectors.

“We went from having to turn away about 3/4 people applying to work with us, weekly. To – can’t find anyone, and not sure who is actually working? Did an estimated 15% of the entire workforce disappear? And we are in a highly specialized business too!,” said Frank Cirino, Jr. of Cayman Security, Inc in Florida.

Jeff Snell of ENLIGN Advisors in North Carolina notes “The labor market is especially not improving in blue-collar trades where experienced labor is retiring and not being backfilled with young talent where employers are unwilling to pay current market wages.” This is a trend to pay close attention to as more of the workforce reaches retirement age.

In addition to job growth, the June Consumer Price Index (CPI), a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services by the U.S. Bureau of Labor Statistics, arrived with a 3% YOY headline increase. This compared to 3.1% expectations and a strong decline from 9.1% YOY in June of 2022.

While at face value, the CPI data might hint at a cause for a prolonged pause in rate hikes, it’s important to note that much of the decline came from the volatile energy sector which was down 16.7% YOY with the help of a 26.5% and 36.6% drop in gasoline and fuel oil, respectively. Counter to that trend, food, shelter, and transportation all rose higher, up 5.7%, 7.5%, and 8.2% respectively. Progress on the surface, but fuel for continued hikes beneath.

With signs of continued rate hikes and higher cost of capital as a result, a silver lining lays within today’s macro conditions and serves as the catalyst to keep the business-for-sale market on-track. Baby boomers make up a large percentage of small business owners in the U.S. and experts have been calling for a ‘Silver Tsunami’ of these operators to exit in waves. In fact, 47% of surveyed sellers gave retirement as their motivation and 34% cited burnout.

This is where the small business market differs markedly from real estate. It may be easier for aging homeowners to hang on for an improved housing market, however, it’s more of a challenge for older owners, many of which having gone through recession, pandemic, and now contrarian work beliefs from a much younger generation.

“We are seeing a lot of baby boomers that are just plain worn out and want to sell regardless of economic concerns. Sellers that have survived the great recession and the pandemic are used to pivoting and if they can, they are,” said Loftin.

If ready to exit, experts recommend that owners understand their business value, can justify their price, and how it might fluctuate as rates change. “Higher rates mean higher debt service, which leaves less money for the owner salary and cushion,” said Campbell. “We have become very conscientious of debt service in our pricing so as not to over price ourselves. Buyers have certainly taken the higher rates into consideration.”

Robert Flynn of Northeast based United Brokers Group LLC notes the importance of third-party business appraisals, which he says have become much more popular than 10 years ago as buyers want an unbiased opinion to negate risk. The same trend also applies to sellers. “As with commercial real estate appraisals, intelligent sellers want an objective appraisal of the value of their business before setting an asking price. Set the price properly and then defend it with a third-party opinion.”

To re-emphasize an earlier topic in this report, owners should seriously consider financing part of the deal. “This is a sign to buyers that you are confident in your business and ultimately allows you to get more for your business. With interest rates in the double digits, it’s a great selling point to offer and at a great ROI that is hard to match anywhere else,” says Cockcroft.

On this topic, Flynn cautions owners offering financing to understand the increased Debt Service Coverage (DSC) requirements by many major 7(a) lenders as well as recent changes in the SBA SOP for seller note repayment. A good business broker can advise on these changes and draw out a proper payment structure to protect all parties.

For owners with an exit on the horizon, it’s critical to keep in mind that selling a business can take upwards of 12-months to complete. As such, those on the brink should get their books in order and establish a relationship with a broker who matches their criteria now versus drawing out what can already be a lengthy process.

Finally, for entrepreneurs looking to buy, just as there is never a bad time to make money, there is never a bad time to buy a business. Just be sure it’s the right business, provides the right lifestyle, and on a payment schedule that provides a cushion.

As said by Barrios, a business buyer in Kentucky, “I firmly believe that 2023 and 2024 will present the best opportunities to buy a well-established business, at a good price and with a good profit margin, as long as you understand what you are doing, you are passionate about being an entrepreneur and you are mentally and financially prepared.”